by Karl Widerquist | Dec 3, 2017 | Opinion, The Indepentarian

So many countries are currently conducting or seriously talking about starting Universal Basic Income (UBI) experiments that it’s becoming hard to keep track. These are not the first experiments in UBI or other forms of Basic Income Guarantee (BIG). Namibia and India conducted UBI experiments in the late 2000s and early 2010s. And between 1968 and 1980, the U.S. and Canadian Government conducted five Negative Income Tax (NIT) experiments. They were the world’s first major social science experiments of any kind. They are worth reviewing because they provide not only inspiration and precedent but also relevant data and important lessons for the current experiments.

I’m working on a book (tentatively titled Basic Income Experiments: The Devil’s in the Caveats) drawing lessons from the ’70s experiments for the current round of experiments. This blog post previews a chapter from that upcoming book providing a review of results from the 1970s experiments. The chapter, in turn, draws heavily on my earlier work on BIG experiments including “A Failure to Communicate: What (if anything) Can We Learn from the Negative Income Tax Experiments” and “A Retrospective on the Negative Income Tax Experiments: Looking Back at the Most Innovative Field Studies in Social Policy.” Next week, I’ll make a blog post showing how poorly understood the NIT experiments were in the media at the time.

Labor market effects

Unfortunately, most of the attention of the 70s experiments was directed not at the effects of the policy (how much does it improve the welfare of low-income people) but to one potential side effect (how does it affect labor hours of test subjects). And so that issue takes up most of the discussion here.

Table 1 summarizes the basic facts of the five NIT experiments. The first, the New Jersey Graduated Work Incentive Experiment (sometimes called the New Jersey-Pennsylvania Negative Income Tax Experiment or simply the New Jersey Experiment), was conducted from 1968 to 1972. The treatment group originally consisted of 1,216 people and dwindled to 983 (due to dropouts) by the conclusion of the experiment. Treatment group recipients received a guaranteed income for three years.

The Rural Income Maintenance Experiment (RIME) was conducted in rural parts of Iowa and North Carolina from 1970 to 1972. It began with 809 people and finished with 729.

The largest NIT experiment was the Seattle/Denver Income Maintenance Experiment (SIME/DIME), which had an experimental group of about 4,800 people in the Seattle and Denver metropolitan areas. The sample included families with at least one dependent and incomes below $11,000 for single-parent families or below $13,000 for two-parent families. The experiment began in 1970 and was originally planned to be completed within six years. Later, researchers obtained approval to extend the experiment for 20 years for a small group of subjects. This would have extended the project into the early 1990s, but it was eventually canceled in 1980, so that a few subjects had a guaranteed income for about nine years, during part of which time they were led to believe they would receive it for 20 years.

The Gary Income Maintenance Experiment was conducted between 1971 and 1974. Subjects were mostly black, single-parent families living in Gary, Indiana. The experimental group received a guaranteed income for three years. It began with a sample size of 1,799 families, which (due to a large drop-out rate) fell to 967 by the end of the experiment.

The Canadian government initiated the Manitoba Basic Annual Income Experiment (Mincome) in 1975 after most of the U.S. experiments were winding down. The sample included 1,300 urban and rural families in Winnipeg and Dauphin, Manitoba with incomes below C$13,000 per year. By the time the data collection was completed in 1978, interest in the guaranteed income was seriously on the wane and the Canadian government canceled the project before the data was analyzed.

Table 1: Summary of the Negative Income Tax Experiments in the U.S. & Canada

| Name |

Location(s) |

Data collection |

Sample size:

Initial (final) |

Sample Characteristics |

G* |

t** |

| The New Jersey Graduated Work Incentive Experiment (NJ) |

New Jersey & Pennsylvania |

1968-1972 |

1,216 (983) |

Black, white, and Latino, 2-parent families in urban areas with a male head aged 18-58 and income below 150% of the poverty line. |

0.5

0.75

1.00

1.25 |

0.3

0.5

0.7 |

| The Rural Income-Maintenance Experiment (RIME) |

Iowa & North Carolina |

1970-1972 |

809 (729) |

Both 2-parent families and female-headed households in rural areas with income below 150% of poverty line. |

0.5

0.75

1.00 |

0.3

0.5

0.7 |

| The Seattle/Denver Income-Maintenance Experiments (SIME/DIME) |

Seattle & Denver |

1970-1976,

(some to 1980) |

4,800 |

Black, white, and Latino families with at least one dependant and incomes below $11,00 for single parents, $13,000 for two parent families. |

0.75, 1.26, 1.48 |

0.5

0.7,

0.7-.025y,

08-.025y |

| The Gary, Indiana Experiment (Gary) |

Gary, Indiana |

1971-1974 |

1,799 (967) |

Black households, primarily female-headed, head 18-58, income below 240% of poverty line. |

0.75

1.0 |

0.4

0.6 |

| The Manitoba Basic Annual Income Experiment (Mincome) |

Winnipeg and Dauphin, Manitoba |

1975-1978 |

1,300 |

Families with, head younger than 58 and income below $13,000 for a family of four. |

C$3,800

C$4,800

C$5,800 |

0.35

0.5

0.75 |

* G = the Guarantee level.

** t = the marginal tax rate

Source: Reproduced from Widerquist (2005)

Scholarly and popular media articles on the NIT experiments focused, more than anything else, on the NIT’s “work-effort response”—the comparison of how much the experimental group worked relative to the control group. Table 2 summarizes the findings of several of the studies on the work-effort response to the NIT experiments, showing the difference in hours (the “work reduction”) by the experimental group relative to the control group in foregone hours per year and in percentage terms. Results are reported for three categories of workers, husbands, wives, and “single female heads” (SFH), which meant single mothers. The relative work reduction varied substantially across the five experiments from 0.5% to 9.0% for husbands, which means that the experimental group worked less than the control group by about ½ hour to 4 hours per week, 20 to 130 hours per year, or 1 to 4 fulltime weeks per year. Three studies averaged the results from the four U.S. experiments and found relative work reduction effects in the range of 5% to 7.9%.[i]

The response of wives and single mothers was somewhat larger in terms of hours, and substantially larger in percentage terms because they tended to work fewer hours, to begin with. Wives reduced their work effort by 0% to 27% and single mothers reduced their work effort by 15% to 30%. These percentages correspond to reductions of about 0 to 166 hours per year. The labor market response of wives had a much larger range than the other two groups, but this was usually attributed to the peculiarities of the labor markets in Gary and Winnipeg where particularly small responses were found.

Table 2: Summary of findings of work reduction effect

| Study |

Data Source |

Work reduction*

in hours per year ** and percent |

Comments and Caveats |

| Husbands |

Wives |

SFH |

| Robins (1985) |

4 U.S. |

-89

-5% |

-117

-21.1% |

-123

-13.2% |

Study of studies that does not assess the methodology of the studies but simply combines their estimates. Finds large consistency throughout, and “In no case is there evidence of a massive withdrawal from the labor force.” No assessment of whether the work response is large or small or its effect on cost. Estimates apply to a poverty-line guarantee rate with a marginal tax rate of 50%. |

| Burtless (1986) |

4 U.S. |

-119

-7% |

-93

-17% |

-79

-7% |

Average of results of the four US experiments weighted by sample size, except for the SFH estimates, which are a weighted average of the SIME/DIME and Gary results only. |

| Keeley (1981) |

4 U.S. |

-7.9% |

|

|

A simple average of the estimates of 16 studies of the four U.S. experiments |

| Robins and West (1980a) |

SIME/

DIME |

-128.9

-7% |

-165.9

-25% |

-147.1

-15% |

Estimates “labor supply effects.” It goes without saying that this is different from “labor market effects.” |

| Robins and West (1980b) |

SIME/

DIME |

-9% |

-20% |

-25% |

Recipients take 2.4 years to fully adjust their behavior to the new program. |

| Cain et al (1974) |

NJ |

– |

-50

-20% |

– |

Includes caveats about the limited duration of the test and the representativeness of the sample. Notes that the evidence shows a smaller effect than nonexperimental studies. |

| Watts et al (1974) |

NJ |

-1.4% to

-6.6% |

– |

– |

Depending on size of G and t |

| Rees and Watts (1976) |

NJ |

-1.5 hpw**

-0.5% |

-0.61% |

– |

Found anomalous positive effect on hours and earnings of blacks. |

| Ashenfelter (1978) |

RIME |

-8%

|

-27% |

– |

“There must be serious doubt about the implications of the experimental results for the adoption of any permanent negative income tax program.” |

| Moffitt (1979a) |

Gary |

-3% to -6% |

0% |

-26% to -30% |

No caveat about missing demand, but careful not to imply the results mean more than they do. |

| Hum and Simpson (1993a) |

Mincome |

-17

-1% |

-15

-3% |

-133

-17% |

Smaller response to the Canadian experiment was not surprising because of the make-up of the sample and the treatments offered. |

* The negative signs indicate that the change in work effort is a reduction

** Hours per year except where indicated “hpw,” hours per week.

NJ = New Jersey Graduated Work Incentive Experiment

SIME/DIME = Seattle / Denver Income Maintenance Experiment

Gary = Gary Income Maintenance Experiment

RIME = Rural Income Maintenance Experiment

Mincome = Manitoba Income Maintenance Experiment

SFH = Single Female “head of household.”

Source: Reproduced from Widerquist (2005)

All or most of the figures reported above are raw comparisons between the control and experimental groups: they are not predictions of how labor market participation is likely to change in response to an NIT or UBI. There are many reasons why these figures can’t be taken as predictions of responses to a national program. The many difficulties of relating experimental results to such predictions is a major theme in the book I’m writing. I’ll mention just four of them now.

First, the study participants were drawn only from a small segment of the population: people with incomes near the poverty line, about the point at which people are most likely to work less in response to an income guarantee because the potential grant is high relative to their earned income. Thus, the response of this group is likely to be much larger than the response of the entire workforce to a national program. One study using computer simulations estimated that the work reduction in response to a national program would be only about one-third of reduction in the Gary experiment (1.6% rather than 4.5%).[ii] Although simulations are an important way to connect experimental data with what we really want to know, the more researchers rely on them the less their reports are driving by their experimental data.

Second, the figures do not include any demand response, which economic theory predicts would lead to higher wages and a partial reversal of the work-reduction effect. One study using simulation techniques to estimate the demand response found it to be small.[iii] Another found, “Reduction in labor supply produced by these programs does tend to raise low-skill wages, and this improves transfer efficiency.”[iv] That is, it increases the benefit to recipients from each dollar of public spending.

Third, the figures were reported in average hours per week and very often misinterpreted to imply that 5% to 7.9% of primary breadwinners dropped out of the labor force. The reduction in labor hours was not primarily caused by workers reducing their hours of work each week (as few workers are able to do even if they want to). Moreover, few if any workers simply dropped out of the labor force for the duration of the study, as knee-jerk reactions to guaranteed income proposals often assume.[v] Instead, it was mainly caused by workers taking longer to find their next job if and when they became nonemployed.

Fourth, the experimental group’s “work reduction” was only a relative reduction in comparison to the control group. Although this language is standard for experimental studies, it doesn’t imply that receiving the NIT was the major determinate of labor hours. In fact, in some studies, labor hours increased for both groups, and the labor hours of both groups tended to rise and fall together along with the macroeconomic health of the economy—implying that when more or better jobs were available, both groups took them, but when they were less available, the control group searched harder or accepted less attractive jobs.[vi]

As I’ll show in my next article about the NIT experiments, most laypeople writing about the results assumed any work reduction, no matter how small, to be an extremely negative side effect. But it is not obviously desirable to put unemployed workers in the position where they are desperate to start their next job as soon as possible. It’s obviously bad for the workers and families in that position. It’s not only difficult to go through but also it reduces their ability to command good wages and better working conditions. Increased periods of nonemployment might have a social benefit if they lead to better matches between workers and firms.

Non-labor-market effects

The focus of the 1970s experiments on work effort is in one way surprising because presumably, the central goals of a UBI involve its effects on poverty and the wellbeing of relatively low-income people, and assessing these issues requires look at non-labor-market effects.

The experimental results for various quality-of-life indicators were substantial and encouraging. Some studies found significant positive influences in elementary school attendance rates, teacher ratings, and test scores. Some studies found that children in the experimental group stayed in school significantly longer than children in the control group. Some found an increase in adults going on to continuing education. Some of the experiments found desirable effects on many important quality-of-life indicators, including reduced incidents of low-birth-weight babies, increased food consumption, and increased nutritional content of the diet. Some even found reduced domestic abuse and reduced psychiatric emergencies.[vii]

Much of the attention to non-labor market effects focused not on the presumed goals of the policy but on another side effect: a controversial finding that the experimental group in SIME-DIME had a higher divorce rate than the control group. Researchers argued forcefully on both sides with no conclusive resolution in the literature. The finding was not replicated by the Manitoba experiment, which found a lower divorce rate in the experimental group. The higher divorce rate in some studies examining SIME-DIME was widely presented as a negative effect, even though the only explanation for it that researchers on either side were that the NIT must have relieved women from financial dependence on husbands.[viii] It is at the very least questionable to label one spouse staying with another solely because of financial dependence as a “good” thing.

An overall comparison?

Most of the researchers involved considered the results extremely promising overall. Comparisons of the control and experimental group indicated that the NIT was capable of significantly reducing the material effects of poverty, and the relative reductions in labor effort were probably within the affordable range and almost certainly within the sustainable range.

But experiments of this type were not capable of producing a bottom line. Non-specialists examining these results might find themselves asking: What was the cost exactly? How much were the material effects of poverty reduced? What is the verdict from an overall comparison of costs and benefits?

Experiments cannot produce an answer to these questions. Doing so would involve taking positions on controversial normative issues, combining the experimental results with a great deal of nonexperimental data, and plugging it into a computer model estimating the micro- and macroeconomic effects of a national policy. The results of that effort would be driven more by those normative positions, nonexperimental data, and modeling assumptions than by the experimental results that such a report would be designed to illustrate.

Whichever strategy experimental reports take, nonspecialists will have difficulty grasping the complexity of the results and the limits of what they indicate about a possible national policy. No matter how well the experiment is conducted, the results are vulnerable to misunderstanding, misuse, oversimplification, and spin. My blog post next week will show how badly this happened when the results of NIT experiments were reported in the United States in the 1970s.

[i] G. Burtless, “The Work Response to a Guaranteed Income. A Survey of Experimental Evidence,” in Lessons from the Income Maintenance Experiments, ed. A. H. Munnell (Boston: Federal Reserve Bank of Boston, 1986). M.C. Keeley, Labor Supply and Public Policy: A Critical Review (New York: Academic Press, 1981). P.K. Robins, “A Comparison of the Labor Supply Findings from the Four Negative Income Tax Experiments,” Journal of Human Resources 20, no. 4 (1985).

[ii] R.A. Moffitt, “The Labor Supply Response in the Gary Experiment,” ibid.14 (1979).

[iii] D.H. Greenberg, “Some Labor Market Effects of Labor Supply Responses to Transfer Programs,” Social-Economic Planning Sciences 17, no. 4 (1983).

[iv] J.H. Bishop, “The General Equilibrium Impact of Alternative Antipoverty Strategies205-223,” Industrial and Labor Relations Review 32, no. 2 (1979).

[v] Robert Levine et al., “A Retrospective on the Negative Income Tax Experiments: Looking Back at the Most Innovative Field Studies in Social Policy,” in The Ethics and Economics of the Basic Income Guarantee, ed. Karl Widerquist, Michael A. Lewis, and Steven Pressman (Aldershot: Ashgate, 2005).

[vi] Karl Widerquist, “A Failure to Communicate: What (If Anything) Can We Learn from the Negative Income Tax Experiments?,” The Journal of Socio-Economics 34, no. 1 (2005).

[vii] Levine et al, 2005.

[viii] Levine et al, 2005; Widerquist, 2005.

by Karl Widerquist | Nov 26, 2017 | Opinion, The Indepentarian

This post is one of several previewing the book I’m writing on Universal Basic Income (UBI) experiments, and it is the second of two reviewing the five Negative Income Tax (NIT) experiments conducted by the U.S. and Canadian Government in the 1970s. This post draws heavily on my earlier work, “A Failure to Communicate: What (if anything) Can We Learn from the Negative Income Tax Experiments.”

Last week I argued that the results from the NIT experiments for various quality-of-life indicators were substantial and encouraging and that the labor-market effects implied that the policy was affordable. As promising as the results were to the researchers involved the NIT experiments, they were seriously misunderstood in the public discussion at the time. But the discussion in Congress and in the popular media displayed little understanding of the complexity. The results were spun or misunderstood and used in simplistic arguments to reject NIT or any form of guaranteed income offhand.

The experiments were of most interest to Congress and the media during the period from 1970 to 1972, when President Nixon’s Family Assistance Plan (FAP), which had some elements of an NIT, was under debate in Congress. None of the experiments were ready to release final reports at the time. Congress insisted researchers produce some kind of preliminary report, and then members of Congress criticized the report for being “premature,” which was just what the researchers had initially warned.[i]

Results of the fourth and largest experiment, SIME/DIME, were released while Congress was debating a policy proposed by President Carter, which had already moved quite a way from the NIT model. Dozens of technical reports with large amounts of data were simplified down to two statements: It decreased work effort and it supposedly increased divorce. The smallness of the work disincentive effect hardly drew any attention. Although researchers going into the experiments agreed that there would be some work disincentive effect and were pleased to find it was small enough to make the program affordable, many members of Congress and popular media commentators acted as if the mere existence of a work disincentive effect was enough to disqualify the program. The public discussion displayed little, if any, understanding that the 5%-to-7.9% difference between the control and experimental groups is not a prediction of the national response. Nonacademic articles reviewed by one of the authors[ii] showed little or no understanding that the response was expected to be much smaller as a percentage of the entire population, that it could potentially be counteracted by the availability of good jobs, or that it could be the first step necessary for workers to command higher wages and better working conditions.

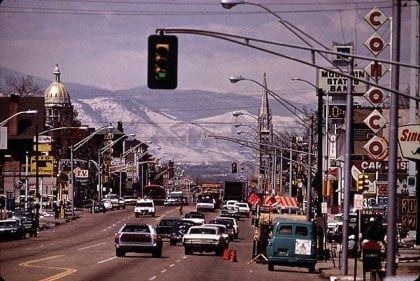

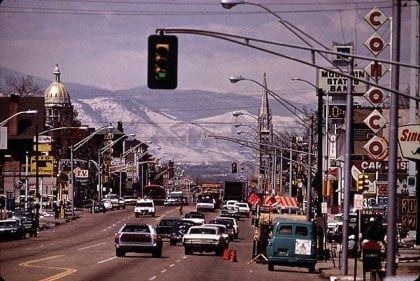

The United Press International simply got the facts wrong, saying that the SIME/DIME study showed that “adults might abandon efforts to find work.” The UPI apparently did not understand the difference between increasing search time and completely abandoning the labor market. The Rocky Mountain News claimed that the NIT “saps the recipients’ desire to work.” The Seattle Times presented a relatively well-rounded understanding of the results, but despite this, simply concluded that the existence of a decline in work effort was enough to “cast doubt” on the plan. Others went even farther, saying that the existence of a work disincentive effect was enough to declare the experiments a failure. Headlines such as “Income Plan Linked to Less Work” and “Guaranteed Income Against Work Ethic” appeared in newspapers following the hearings. Only a few exceptions such as Carl Rowan for the Washington Star (1978) considered that it might be acceptable for people working in bad jobs to work less, but he could not figure out why the government would spend so much money to find out whether people work less when you pay them to stay home.[iii]

Senator Daniel Patrick Moynihan, who was one of the few social scientists in the Senate, wrote, “But were we wrong about a guaranteed income! Seemingly it is calamitous. It increases family dissolution by some 70 percent, decreases work, etc. Such is now the state of the science, and it seems to me we are honor bound to abide by it for the moment.” Senator Bill Armstrong of Colorado, mentioning only the existence of a work-disincentive effect, declared the NIT, “An acknowledged failure,” writing, “Let’s admit it, learn from it, and move on.”[iv]

Robert Spiegelman, one of the directors of SIME/DIME, defended the experiments, writing that they provided much-needed cost estimates that demonstrated the feasibility of the NIT. He said that the decline in work effort was not dramatic, and could not understand why so many commentators drew such different conclusions than the experimenters. Gary Burtless (1986) remarked, “Policymakers and policy analysts … seem far more impressed by our certainty that the effective price of redistribution is positive than they are by the equally persuasive evidence that the price is small.”[v]

This public discussion certainly displayed “a failure to communicate.” The experiments produced a great deal of useful evidence, but for by-far the greatest part, it failed to raise the level of debate either in Congress or in public forums. The literature review reveals neither supporter nor opponents who appeared to have a better understanding of the likely effects of the NIT and UBI in the discussions following the release of the results of the experiments in the 1970s.[vi]

Whatever the causes for it, an environment with a low understanding of complexity is highly vulnerable to spin with simplistic if nearly vacuous interpretation. All sides spin, but in the late 1970s NIT debate, only one side showed up. The guaranteed income movement that had been so active in the United States at the beginning of the decade had declined to the point that it was able to provide little or no counter-spin to the enormously negative discussion of the experimental results in the popular media.

Whether the low information content of the discussion in the media resulted more from spin, sensationalism, or honest misunderstanding is hard to determine. But whatever the reasons, the low-information discussion of the experimental results put the NIT (and, in hindsight, UBI by proxy) in an extremely unfavorable light, when the scientific results were mixed-to-favorable.

The scientists who presented the data are not entirely to blame for this misunderstanding. Neither can all of it be blamed on spin, sound bites, sensationalism, conscious desire to make an oversimplified judgment, or the failure of reports to do their homework. Nor can all of it be blamed on the people involved in political debates not paying sufficient attention. It is inherently easier to understand an oversimplification than it is to understand the genuine complexity that scientific research usually involves no matter how painstakingly it is presented. It may be impossible to communicate the complexities to most nonspecialists readers in the time a reasonable person to devote to the issue.

Nevertheless, everyone needs to try to do better next time. And we can do better. Results from experiments in conducted in Namibia and India in the early 2010s and late ’00s were much better understood, as resulted from Canada’s Mincome experiment that sadly did not come out until more than two decades after that experiment was concluded.

The book I’m working on is an effort to help reduce misunderstandings with future experiments. It is aimed at a wide audience because it focuses the problem of communication from specialists to non-specialists. I hope to help researchers involved in current and future experiments design and report their findings in ways that are more likely to raise the level of debate; to help researchers not involved in the experiments raise the level of discussion when they write about the findings of the experiment, to help journalists understand and report experimental findings more accurately; and to help interested citizens of all political predispositions see beyond any possible spin and media misinterpretations to the complexities of the results of this next round of experiments—whatever they turn out to be.

[i] Widerquist, 2005.

[ii] Widerquist, 2005.

[iii] Widerquist, 2005.

[iv] Widerquist, 2005.

[v] Burtless, 1986.

[vi] Widerquist, 2005.

by Sara Bizarro | Nov 18, 2017 | News

Peter S. Goodman, a veteran economics journalist, wrote a comprehensive piece about the recent Basic Income developments for the New York Times. In this piece, Goodman refers to the main motivations behind the idea of Basic Income as including the current wage stagnation, the lack of jobs to support the middle class and the threat of automation. The idea, Goodman says, is “gaining traction in many countries as a proposal to soften the edges of capitalism.” Basic Income can be use to insure “food and shelter for all, while removing the stigma of public support.”

The article also refers to several Basic Income experiments currently underway. In Europe, the article includes the experiments in Finland, Netherlands and Barcelona. In the USA, the article mentions the experiments being prepared in Oakland and Stockton, CA. Also mentioned are the Canadian experiment in Ontario and the experiment in Kenya organized by Give Directly.

Regarding how to finance Basic Income, Goodman says that the cost of Basic Income is a simple multiplication of amount of money distributed by the amount of people. He says: “Give every American $10,000 a year — a sum still below the poverty line for an individual — and the tab runs to $3 trillion a year. That is about eight times what the United States now spends on social service programs. Conversation over.” This argument however, has been challenged by several Basic Income researchers, including Karl Widerquist, who is was interviewed and quoted in the piece. In his paper “The Cost of Basic Income: Back-of-the-Envelope Calculations”, Widerquist says that the cost of Basic Income is “is often misunderstood and greatly exaggerated.” In the paper, Widerquist argues that a Basic Income of “$12,000 per adult and $6,000 per child with a 50% marginal tax rate” would cost “$539 billion per year: about one-sixth its often-mentioned but not-very-meaningful gross cost of about $3.415 trillion.“

Beyond the issue of financing, the article covers a lot of ground regarding current discussion of Basic Income and its motivation, as compared to other social security schemes. Goodman refers to the bureaucracy of social support and the poverty trap, when “people living on benefits risk losing support if they secure other income” and the idea that “poor people are better placed than bureaucrats to determine the most beneficial use of aid money.” The article also refers to the left wing worry that Basic Income could be an excuse to cut social programs, “given that the American social safety programs have been significantly trimmed in recent decades.”

The piece closes with an acknowledgement that Basic Income “appears to have found its moment” and a quote by Guy Standing, saying that, “The interest is exploding everywhere, and the debates now are extraordinarily fertile.”

More information:

Peter S. Goodman, “Capitalism Has a Problem. Is Free Money the Answer?”, New York Times, November 15, 2017